“Don’t wait to buy real estate. Buy real estate and wait.”

Hello and welcome to another edition of Mini Millionaires.

We’ve loved hearing all about your mini millionaire journey, so please keep those replies and DMs coming through. We read every message.

In this week’s edition, we’re talking about how to teach kids about investing in real estate.

Kids typically just see a building as a place where they live, go to school, or where they buy cool stuff from. But by broadening their horizons that they can actually invest in these places and turn a profit for themselves over time, we open their eyes to a whole new world of investment possibilities.

And while it might be a really big concept for your mini millionaire to grasp, already having the conversation, and even sharing if you’ve invested in real estate yourself, goes a long way in getting yet another smart money conversation going.

BUT, before we dive into this week’s edition, we’re excited to share that Fintr is in the running for the EdTech Startup of the Year in the 2025 South African Startup Awards.

Please take a moment to vote for Fintr. Hit the button below, click the 👍 to vote for us, enter your email address, and then confirm your vote. Nice and simple. We greatly appreciate your support.

Game On

🏡 Making Money From Your House: A real estate lesson for kids.

🫰 Up For Rent: Did you know you can earn from what you own?

🧑🏫 Next Level EMS Classes: Fintr4Schools in your School.

🤝 Car Financing Poll: We reveal what you wished you’d known.

Money Smart

Bringing it home.

Kids are surrounded by different types of property.

Houses, blocks of flats, complexes, and even business parks. But rarely do they think of these as “investments”. For them, it’s simply home.

So when we teach our mini millionaires about real estate investing, we’re actually giving them a new lens with which to see property through. It’s a lens of ownership, growth and value over time.

Instead of talking about bonds and flipping houses, we can teach them that when you own a piece of something valuable and keep it, it often grows.

It’s especially powerful because it links the familiar (their home) to the future (value and income).

1. A mindset to cultivate

Ownership grows over time

Real estate is about holding, not hopping.

Property prices have increased nearly 100% across all major South African metros, with Cape Town leading the way at 141%, and the ‘lowest’ performing metro, Johannesburg, still seeing a 71% increase.

There’s a clear pattern: if you hold land or a home, its value tends to increase over time rather than disappear overnight. Instilling this mindset helps kids shift from “instant” to “steady” thinking.

Takeaway: Encourage children to think long-term that owning something valuable can mean growth, and not just cost.

2. A habit to form

Let them notice value changes.

Start a regular habit: pick a local property you walk or drive past frequently and then look and see if you can find a current or most recent listing price.

Then take a look again in a few months. Try and see if you can find historical data on prices on property listing sites.

These concrete examples anchor abstract ideas. Research in educational psychology shows children learn abstract concepts more effectively when they first engage with concrete, familiar things.

So when your mini millionaire actively monitors a home’s price change, they begin to internalise how value can shift.

And don't worry if you don't see a change immediately. The longer it takes, the better the lesson gets.

Takeaway: The habit builds awareness of how value evolves.

3. A tip to try

Create a mini-rental game at home.

Equip your mini millionaire with a small asset they can manage. Maybe it’s a toy shelf, a craft box, or even a board games corner.

Create a “rental” system where other family members pay a small fee to borrow something.

This simulates the idea of owning an asset and earning from it.

This small action will help them understand that owning property doesn’t only mean owning a house, but that they can actually generate income from it.

Takeaway: Let kids feel the difference between owning something and earning from it.

Your Thoughts…

POLL: Which real estate lesson do you reckon would land best with your mini millionaire?

Use This

Rent for Rands Resource

This week’s free resource is our ‘Rent for Rands’ activity that teaches kids one of the most important investing lessons: assets can earn income.

‘Rent for Rands’ walks your mini millionaire through choosing something they already own, like a toy, a bike, or even their favourite book, and then turning it into a fun rental listing.

They set the price, decide the rental period, and design their own advert, just like a real property owner.

It’s simple, creative, and helps kids feel the difference between owning something and earning money from it. It’s the perfect first step into real estate thinking.

Class is in session

Get schooled

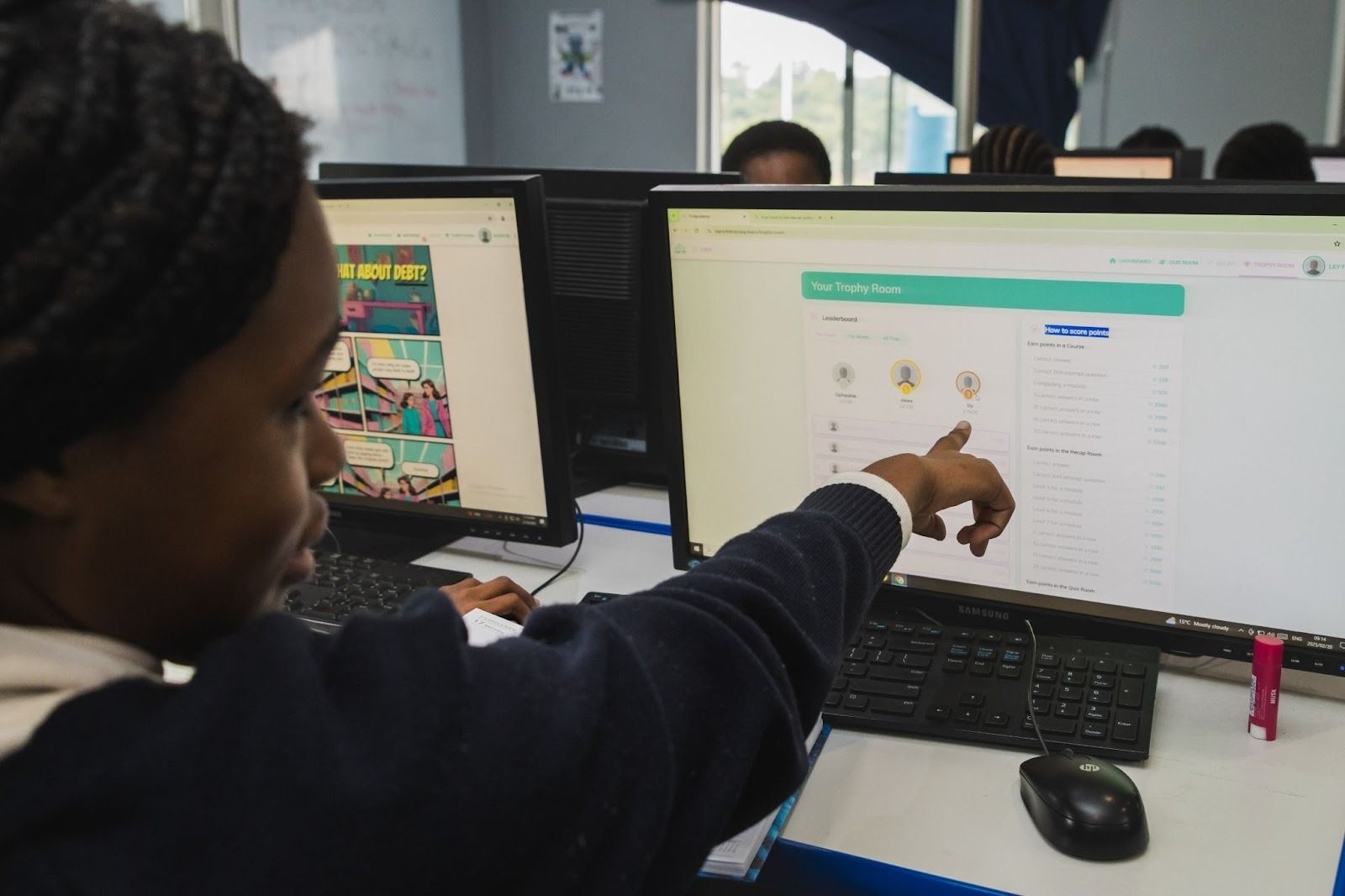

Fintr4Schools makes learning about money as fun as spending it. This gamified digital platform turns the CAPS EMS curriculum into an adventure, with savings skills at the heart of the mission.

Learners set goals, track progress, and master the art of delayed gratification through story-driven challenges, like fighting the money villain, Saverstrain.

Along the way, they pick up:

Superhero savings habits

Smart money choices

Money skills that last a lifetime

Built for classrooms. Backed by experts. (Certified 93% by Education Alliance Finland.)

So, whether you’re a school principal, an EMS teacher, or even a parent of kids in school, let’s talk about bringing Fintr4Schools to your school.

The Tribe Has Spoken

In last week’s Mini Millionaires’ Poll, we wanted to know which part of car financing do you wish you had learned earlier. Seems knowing to buy new, used, or to keep on saving is what we wished we’d known…

🟨🟨🟨⬜️⬜️ 🚗 How interest actually works on a car loan

⬜️⬜️⬜️⬜️⬜️ 💸 How to know what you can really afford

🟨🟨⬜️⬜️⬜️ 🛠️ The “hidden costs” of owning a car

🟩🟩🟩🟩🟩 🤝 Whether it’s better to buy new, used, or keep saving

⬜️⬜️⬜️⬜️⬜️ 📉 How car value drops over time

What you said:

“My first real car purchase had a balloon payment. I will never ever ever for as long as I live. Caused major issues at the end of my payments term...”

J

Painful. They should get a much less joyous term for that, tbh. 🎈

But Before You Go…

We’ve been nominated for the 2025 South African Startup Awards in the EdTech Startup of the Year category. Please take a moment to vote for Fintr. Hit the button below, on the voting site, click the 👍 to vote for us, enter your email address, and then confirm your vote (double-check your spam folder just in cases).

Let’s Connect

Have you tried any of today’s featured exercises yet?

What worked, what didn’t? Or did one of them get you particularly excited?

We’d love to get your thoughts so please hit reply to this email and share your thoughts.

PS: Did someone forward you this email? Subscribe here.